6 Simple Ways to Track and Manage Your Expenses

We all know how much we make in a month; the challenging part is usually how much we spent and most importantly what we spend it on. This is where tracking your expenses come into play. Proper financial management require tracking our expenses to know the items that make up our living costs. By knowing we can better manage and reduce our expenses, as necessary. We have highlighted 6 quick ways below.

Go through your account statements

Every month create time to go through the details of your bank transactions to see where your money has been spent and to ensure that your money is going into the right places. Manage your money habits by taking an inventory of all your accounts.

Check all Receipts

You get receipts anytime you pay for items online and offline. buy things either online or offline. Ensure you double check on these receipts to avoid incorrect debits.

Categorize your Expenses

Expenses consist of both fixed expenses and variable expenses. Fixed expenses are less likely to change from month to month as these include rent, utilities, which are mostly fixed in the short term. Variable expenses are usually on discretionary items such as food, clothing and travel. Classifying your expenses will give you valuable insight into your finances and guide on how manage your expenses appropriately.

Use a Personal Finance App

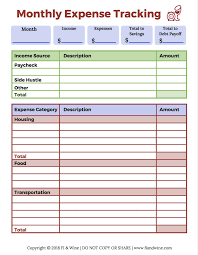

Create a Budget

Tracking your expenses requires using a budget. A budget is your monthly money plan consisting of expected income and expenses put in categories for the whole month.

Read Also: 7 Tips to Improve your Communication Skills

Create an Expense Account

This is a good way to create a spending budget by transferring an amount that should cover all your expenses for the month and paying for them only from that account. This way you can track how much was spent and on what particularly if you go overboard, the reason would be quite easy to see and can be better managed going forward.

Tracking your expenses is particularly important. Financial goals are easily achievable once you have a budget and tracking system in place.