December is often a whirlwind of festivities, with its allure of Detty December outings, endless gift shopping, and impromptu spending sprees. It’s a magical month where the atmosphere is electric, social calendars are packed, and our wallets seem to bleed cash faster than we can blink. But now, it’s January, and for many, the thrill of December has faded, leaving behind the unmistakable sting of a financial hangover.

You know the feeling—that sinking realization when you open your banking app and see how much fun your money had while you weren’t paying attention. If this sounds familiar, don’t panic. You’re not alone, and more importantly, you can recover. Let’s explore practical ways to detox your finances, reset your money mindset, and start the year on a strong financial footing.

Read: Earn More in 2025: Skills You Can Learn in a Day

Assess the Damage: Facing Your Financial Reality

The first step in any recovery is acknowledgment. It’s time to take a deep breath, open your bank and credit card statements, and assess the damage. Yes, it might be painful, but you can’t fix what you don’t know.

Look at how much you spent in December versus your usual monthly expenses. Identify categories that went overboard—was it eating out, gifts, or those late-night detty December turn-ups? Seeing these numbers in black and white gives you a clear picture of where your money went and what you need to tackle.

Start by calculating your post-December net worth: your total assets (savings, investments, etc.) minus your liabilities (debts, credit card balances, etc.). This sobering but necessary step helps you create a realistic action plan.

Prioritize Your Debt: Stop the Bleeding

If your December indulgences left you with credit card debt, this should be your priority. Credit cards carry high interest rates, and the longer you delay payments, the more it costs you. Start listing of your outstanding balances and their respective interest rates.

Focus on paying off the highest-interest debts first—a strategy known as the avalanche method. Alternatively, if you prefer smaller wins to build momentum, the snowball method encourages paying off the smallest debts first. Whichever approach suits you, commit to paying more than the minimum balance to reduce your debt faster.

If possible, transfer your balance to a low-interest or zero-interest credit card. This buys you time to pay down your debt without the added burden of sky-high interest rates.

Implement a “No-Spend January”

The best way to recover from December’s financial splurge is to put your spending on pause. Commit to a “No-Spend January,” where you only spend money on essentials like rent, utilities, groceries, and transportation. This doesn’t mean you can’t have fun, but it forces you to get creative with free or low-cost alternatives.

For instance, swap fancy dinners with potluck nights at home or binge-watch your favorite shows instead of going out. You’ll free up funds to rebuild your savings or tackle your debt by cutting back on non-essential expenses.

This reset also helps curb impulse purchases. December may have been filled with sales and promotions, but January is all about discipline and restraint. Use this month to reflect on your spending habits and train yourself to distinguish between wants and needs.

Read: Planning and Prioritization for the New Year

Rebuild Your Emergency Fund

Once you’ve assessed your debts and trimmed unnecessary expenses, it’s time to focus on rebuilding your emergency fund. An emergency fund is your financial safety net, protecting you from unexpected expenses like car repairs or medical bills.

Ideally, you should aim to save at least three to six months’ worth of living expenses. But if that feels overwhelming, start small. Setting aside 10% of your monthly income can help you gradually rebuild your financial cushion.

Consider automating your savings. Set up a direct debit that transfers a portion of your salary to a separate savings account as soon as you get paid. This ensures you’re prioritizing savings before spending.

Reevaluate Your Budget for the New Year

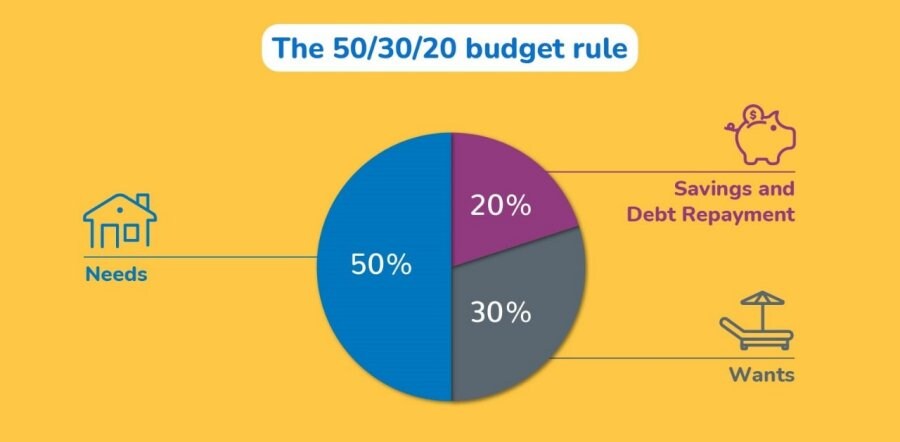

A fresh start calls for a fresh budget. Take the lessons learned from December’s spending spree and use them to create a budget that’s both realistic and reflective of your goals. Start by categorizing your expenses into needs, wants, and savings. Allocate a specific percentage of your income to each category, and be strict about staying within those limits.

Technology can help. Use budgeting apps like Mint, YNAB (You Need A Budget), or Cowrywise to track your spending in real-time. These tools can send alerts when you’re nearing your budget limits, helping you stay accountable.

Set Financial Goals for the Year

Finally, don’t let December’s financial hangover define the rest of your year. Instead, use it as motivation to set clear financial goals for 2025. Whether it’s saving for a vacation, investing in a business, or building wealth through long-term investments, having a goal keeps you focused.

Break your goals into smaller, actionable steps. For example, if you want to save ₦500,000 by the end of the year, divide it into monthly savings targets. This makes your goals feel more achievable and gives you something to celebrate each month as you hit your targets.

Embrace Financial Accountability

Recovery is always easier with support. Share your financial goals with a trusted friend or family member who can hold you accountable. Alternatively, join an online financial community where you can exchange tips, share progress, and stay motivated.

RefinedNG is here to guide you every step of the way. From budgeting advice to investment tips, our aim is to help you achieve financial freedom. Remember, a strong financial year starts with intentional actions today.