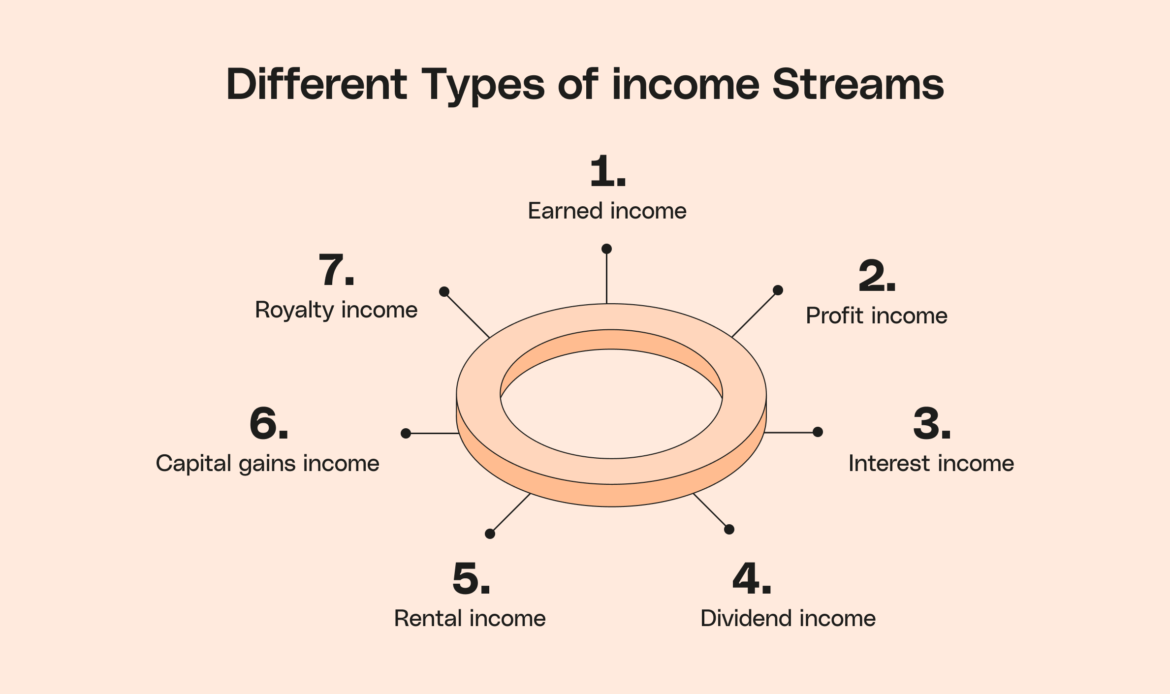

Ah, money—the great enigma. Some say it makes the world go ‘round; others say it’s the root of all evil, but let’s be honest: everyone could use more of it. Whether it’s the thrill of payday, the satisfaction of landing a side hustle gig, or that sweet rental payment hitting your account, income in all its forms is essential to building financial stability. And while most people think income equals salary, here’s the kicker—there are *seven* types of income you can tap into!

Like a jollof rice dish with many layers, money has its own rich layers, too, and understanding them can make all the difference in achieving financial freedom. So, let’s break it down and dive into the seven types of income that can boost your bank balance.

1. Earned Income

Earned income is what most of us are familiar with—it’s that salary or wage you collect at the end of the month for trading your time and energy. Whether you’re a doctor, teacher, mechanic, or even a freelancer, this is the money you work for. It’s the bread and butter of most people’s income streams, but here’s the catch—it’s also the most taxed. While earned income is stable, it usually involves exchanging time for money, and let’s be real, there’s only so much time in the day.

You work Monday to Friday, 9 to 5, and your salary is credited to your account at the end of the month. It’s satisfying but also fleeting—because what’s left by the time rent and bills hit? Not much.

Earned income is great, but don’t limit yourself to it. Diversify your income streams so you’re not solely dependent on your day job.

Read: University of Ghana Chosen to Host 2024 Africa Basketball Festival

2. Profit

Profit is what you get when you buy low and sell high. If you’re running a business—whether it’s selling fashion accessories on Instagram or operating a local bakery—your profit is what’s left after subtracting your expenses from your earnings. This type of income rewards those with an entrepreneurial spirit who can spot opportunities and convert them into cash flow.

Think of it this way – You bought bulk clothes from Balogun Market at a low price and resold them online at a markup. The difference between your selling price and cost is your profit. If you’re good at it, profits can skyrocket!

If you’ve got a knack for spotting good business opportunities, turn it into profit. Just make sure your expenses aren’t eating away at your gains.

3. Interest Income

Interest income is like that quiet friend who always shows up when you need them—it’s not flashy but reliable. You earn interest by lending out your money, whether through a savings account, government bonds, or even a personal loan to a friend (though I’d advise against loaning to friends unless you don’t mind never seeing that money again).

Imagine it this way: You deposit money into a fixed deposit account or buy treasury bills. At the end of a set period, you earn interest on your money without lifting a finger.

Pro Tip: Always monitor interest rates. They fluctuate but can add up over time and provide a nice cushion to your finances.

4. Rental Income

Now, here’s a Nigerian favorite—rental income. This is the money you earn from renting out properties or assets. Whether it’s leasing out a spare room, an apartment, or even a car for Uber, rental income can be a sweet deal because you’re earning money without much ongoing effort once the property or asset is up and running.

Relatable Scenario: You own a small building in Ikeja and rent it out to tenants. Every month, rental payments hit your account, and you barely have to lift a finger—unless a tenant calls about a leaky pipe!

Real estate can be a goldmine in Nigeria but be prepared for occasional hiccups, such as tenant issues or maintenance costs. Still, it’s a great way to generate passive income.

5. Capital Gains

Capital gains come from the increase in the value of an asset over time. This could be anything from real estate to stocks. You buy an asset at one price, and when it appreciates, you sell it at a higher price. Boom—capital gains! Think of it as long-term profit. While you don’t see immediate cash flow, capital gains can deliver a big payday when timed right.

Think of this: You bought shares in Dangote Cement years ago, and the stock price has increased. When you sell those shares, the difference between your buying and selling price is your capital gain.

Patience is key here. Capital gains take time to accumulate, but when done right, they can offer significant returns on your investment.

Read: 7 Things You Should Never Do With Your Money

6. Dividend Income

Dividends are like gifts that are kept on giving. When you invest in stocks, some companies pay you dividends, which is a portion of their profits, to reward you for owning shares. You earn money for simply owning part of a business; no sweat is required.

Relatable Scenario: You hold shares in a Nigerian company like MTN or Zenith Bank. They send you dividends yearly based on their profit performance—easy money!

Look for companies with a strong history of paying dividends. It’s a steady income stream, especially when the stock market fluctuates.

7. Royalty Income

Royalties are the ultimate “get-paid-while-you-sleep” income. If you create something—like a book, music, or even a patent—you can earn royalty payments every time someone buys, uses, or licenses your work. It’s the dream income stream for creatives and innovators.

Relatable Scenario: You wrote a best-selling novel, and every time a copy is sold, you receive a royalty payment. Or maybe you wrote a popular song, and every time it’s streamed or used in a movie, you get a cut.

Pro Tip: If you’ve got a creative talent, leverage it! Royalties can create a steady stream of income without the daily grind.

Money might not grow on trees, but it does grow from multiple sources if you’re smart about it. From earned income to dividends and royalties, diversifying your income streams is the key to building wealth. So, whether you’re working a 9-to-5, selling on the side, or investing in real estate, it’s time to explore these seven types of income and boost your financial game.

Now that you know the seven types of income, which one are you already tapping into? Or better yet, which one are you planning to explore next? Drop a comment, and let’s talk about your money moves!