Picture this: you’re scrolling through your favorite online store, and before you know it, your cart is full of items you never planned to buy. We’ve all been there, feeling the rush of excitement that comes with the click of the “Buy Now” button. But have you ever wondered why we spend the way we do? Understanding the psychology behind our spending habits can help us make better financial decisions and lead to a healthier relationship with money.

Let’s delve into the emotional and cognitive factors that drive our financial behaviors.

The Emotional Side of Spending

Emotions play a significant role in our spending habits. Whether it’s the thrill of a good deal, the comfort of retail therapy, or the satisfaction of treating ourselves, our emotions often guide our purchases. Understanding these emotional triggers can help us become more mindful of our spending and make choices that align with our financial goals.

1. Retail Therapy: The Feel-Good Factor

Often, spending money can be a way to cope with stress, sadness, or boredom. Known as “retail therapy,” this phenomenon is where shopping becomes a temporary fix for emotional distress. The dopamine rush from buying new items can create a short-lived sense of happiness, but it’s essential to recognize this pattern and find healthier ways to address emotional needs.

2. Social Influence: Keeping Up with the Joneses

Social pressure can significantly influence our spending habits. Seeing friends or neighbors with the latest gadgets, fashion, or cars can create a sense of competition or inadequacy, prompting unnecessary purchases to fit in or feel equal. Understanding this can help you make more conscious choices that align with your financial goals rather than societal expectations.

Cognitive Biases and Spending

In addition to emotions, cognitive biases heavily influence our spending decisions. These mental shortcuts can lead us to make irrational choices, such as overspending during sales or underestimating future expenses. We can develop strategies to counteract these biases and improve our financial decision-making by recognizing them.

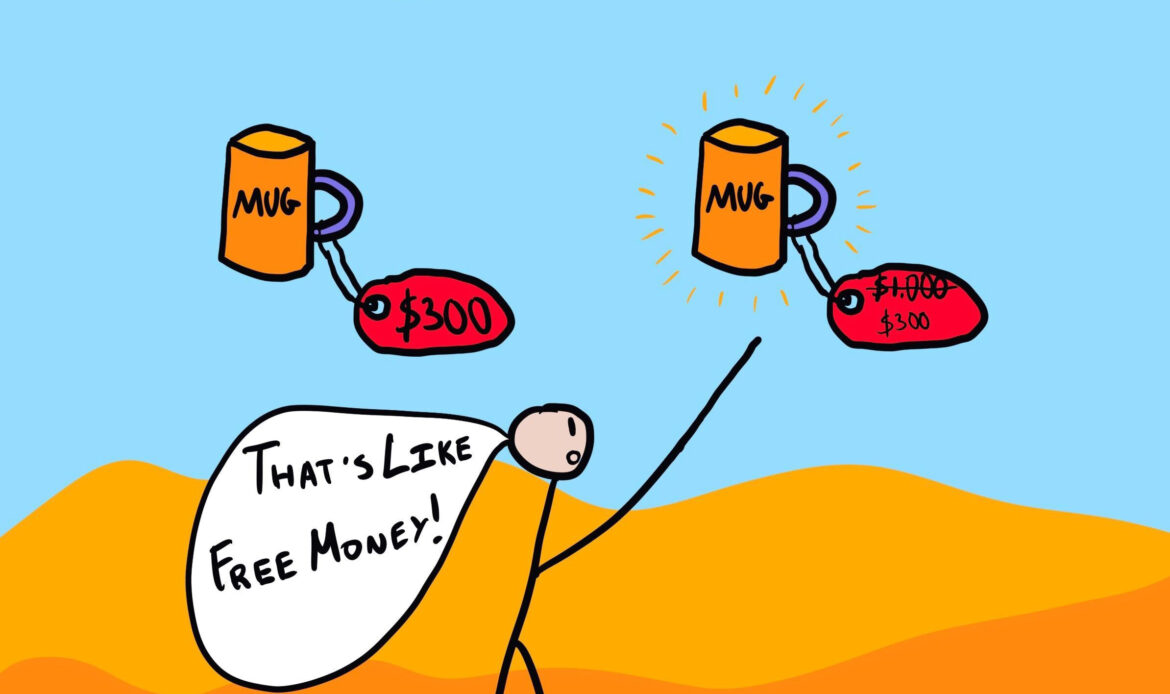

1. The Anchoring Effect

This cognitive bias refers to relying heavily on the first piece of information encountered (the “anchor”) when making decisions. For example, if a high-priced item is displayed next to a moderately priced one, the latter may seem like a better deal, leading to impulsive purchases. Awareness of this bias can help you evaluate your spending more rationally.

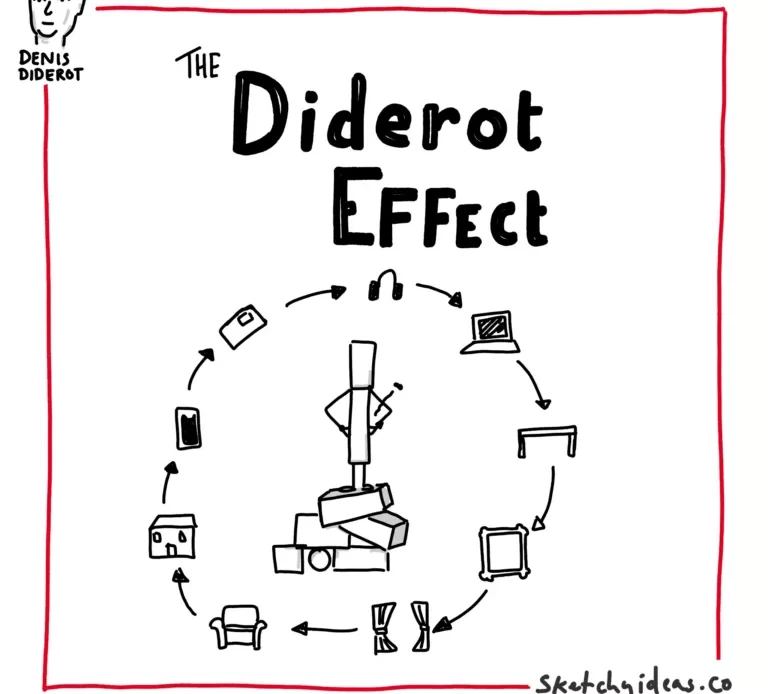

2. The Diderot Effect

Named after French philosopher Denis Diderot, this effect describes how acquiring a new possession can lead to a spiral of additional purchases. For instance, buying a new outfit might lead to buying shoes, accessories, and other complementary items. Recognizing the Diderot Effect can help you avoid unnecessary spending sprees.

Practical Tips for Better Financial Habits

1. Budgeting: The Foundation of Financial Health

Creating and sticking to a budget is fundamental. It helps you track income, expenses, and savings, clearly showing your financial situation. Use budgeting apps or simple spreadsheets to manage your finances and set realistic goals.

2. Delayed Gratification: The 24-Hour Rule

To curb impulsive spending, adopt the 24-hour rule. When tempted to make an unplanned purchase, wait 24 hours before deciding. This cooling-off period often reveals whether the purchase is necessary or a fleeting desire.

3. Automate Savings

Set up automatic transfers to your savings account. This ensures that a portion of your income is saved regularly, reducing the temptation to spend it. Treat your savings like a non-negotiable expense.

Changing Your Spending Mindset

1. Mindful Spending

Mindful spending involves being fully aware of your purchasing decisions. Before buying, ask yourself if the item is a need or a want, and consider how it aligns with your financial goals. This practice can help you make more intentional and beneficial financial choices.

2. Value-Based Spending

Prioritize spending on things that genuinely add value to your life. Invest in experiences or items that bring long-term happiness and fulfillment rather than fleeting joy. This approach ensures that your money is spent meaningfully.

Understanding the psychology of spending is the first step toward better financial habits. You can take control of your finances by recognizing emotional triggers, cognitive biases, and the impact of social influence. Implementing practical tips like budgeting, delayed gratification, and mindful spending will pave the way for a healthier financial future. Remember, it’s not just about earning more but spending wisely.

Take control today and watch your financial well-being flourish. Your future self will thank you!