LemFi, a leading Nigerian fintech platform, has successfully raised $53 million in a Series B funding round, positioning the company to expand its innovative remittance services into Europe and Asia. Founded in 2021 by Ridwan Olalere and Rian Cochran, LemFi has rapidly become a trusted financial services provider for African immigrants worldwide. With this new capital injection, the company is set to redefine cross-border financial solutions for diaspora communities in underserved markets.

A Milestone in African Fintech Growth

The funding round, completed in just four months, was led by Left Lane Capital and included existing investors like Y Combinator and Palm Drive Capital, as well as new backers such as Endeavor Catalyst. This latest round brings LemFi’s total funding to $85 million, underscoring the growing confidence in Africa’s burgeoning fintech ecosystem.

Read: Adebayo Ogunlesi Joins OpenAI’s Board of Directors

CEO Ridwan Olalere described the funding as a critical step in the company’s journey toward global scalability. He emphasized that while navigating regulatory frameworks in diverse markets can be complex, LemFi’s adaptable technology gives the company a unique edge. The platform’s infrastructure allows seamless integration with different payment systems, enabling the company to enter new regions efficiently and precisely.

“Our mission is to redefine how money moves across borders,” Olalere said. “This funding empowers us to bring affordable, reliable, and innovative financial solutions to more immigrant communities around the world.”

Revolutionizing Financial Services for Immigrants

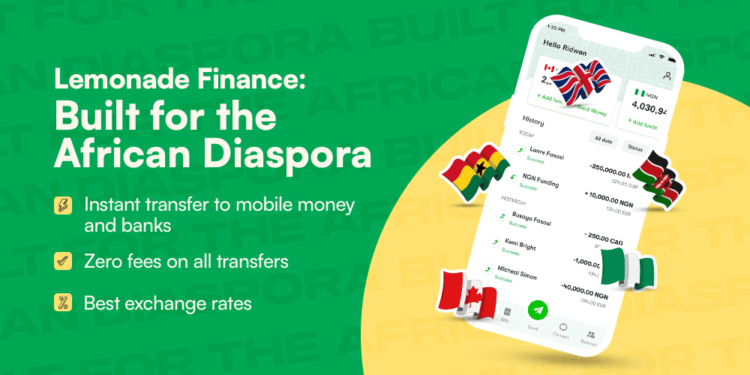

LemFi has carved out a niche in providing localized financial services for immigrants, focusing on affordability and accessibility. The company initially concentrated on payment and remittance solutions, allowing users to send, receive, and hold money in multiple currencies. LemFi’s offerings address long-standing pain points in the traditional remittance industry with zero transaction fees, competitive exchange rates, and instant transfers.

Over the past year, the platform has expanded its capabilities, introducing multi-currency accounts that empower users to conduct global transactions effortlessly. Currently, LemFi operates in 27 “send-from” markets and 20 “send-to” countries, including key corridors such as Nigeria, Kenya, China, India, and Pakistan.

The new funding will allow LemFi to accelerate its European expansion, particularly in markets like the United Kingdom and Germany, which host substantial African immigrant populations. This move is expected to bring LemFi’s localized services to a broader audience, furthering its impact on financial inclusion.

Expanding Operations and Building a Global Footprint

LemFi’s growth ambitions are not limited to geographic expansion. The company plans to scale its technological infrastructure, enhance its product offerings, and recruit top-tier talent to support its operational goals. With a team of over 300 employees spanning Europe, North America, Africa, and Asia, LemFi is well-positioned to execute its vision of transforming global remittances.

The company’s strategic growth comes at a time when African fintech startups are increasingly making their mark on the global stage. Similar success stories, such as Lidya’s foray into Eastern Europe and Zeal’s expansion into the Middle East, highlight the immense potential of Africa’s tech talent to create solutions with global applicability.

Read: Mojisola Meranda Becomes First Female Speaker of Lagos Assembly

Bridging Financial Gaps for Underserved Communities

LemFi’s expansion into Europe and Asia is more than just a business milestone; it’s a step toward addressing the financial exclusion many immigrant communities face. By offering affordable, reliable, and user-friendly solutions, the company is empowering individuals to connect with their loved ones and manage their finances seamlessly across borders.

With $53 million in new funding and the backing of strategic investors, LemFi is poised to significantly impact the global remittance landscape. This achievement reflects not only the company’s innovation and resilience but also the growing influence of Africa’s fintech ecosystem on the world stage.

As LemFi charts its path forward, the company serves as a shining example of how African startups are shaping the future of global financial technology.