Debt. It’s like that stubborn stain on your favorite shirt—you try to ignore it, but it never really goes away until you take serious action. Whether it’s from your credit card, student loans, or that “quick” loan you swore you’d pay off in no time, debt has a sneaky way of overstaying its welcome. And while getting out of debt is possible, many of us unknowingly make mistakes along the way that make the journey much harder than needed.

Let’s be honest: paying off debt is tough enough without throwing avoidable mistakes into the mix. From budgeting slip-ups to using debt to pay off debt (yes, that’s a thing), several pitfalls can keep you trapped in a cycle of owing more and more. But fear not! We’re here to break down some of the most common debt payoff mistakes and how you can dodge them like a pro.

So, if you’re serious about tackling your debt and staying on track, keep reading. We’re about to reveal the debt-repayment blunders that could be slowing you down—and, more importantly, how to fix them.

1. Not Budgeting or Creating a Plan

Trying to pay off debt without a budget is like attempting to cook jollof rice without any ingredients—you’re going nowhere fast. Budgeting is the foundation of every successful financial plan, and when it comes to debt repayment, it’s a non-negotiable.

Without a budget, it’s easy to lose track of where your money is going, making it harder to figure out how much you can allocate toward debt each month. Worse yet, you might overspend in other areas and have nothing left to chip away at that looming balance. A budget gives you clarity and shows you exactly where you can make adjustments to maximize your debt repayments.

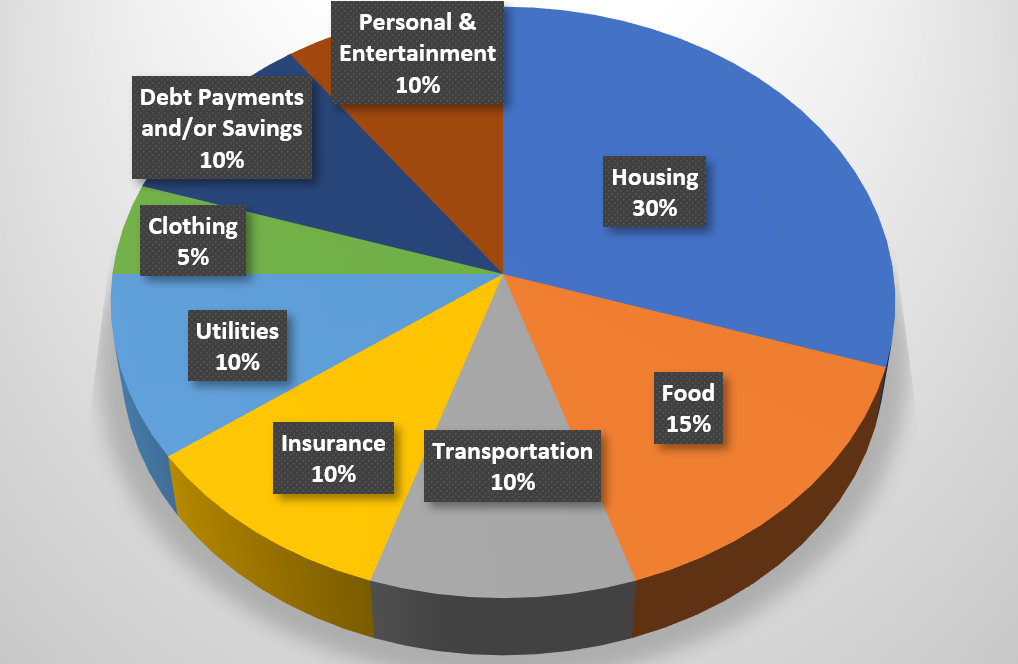

The Fix: Start by listing your income, expenses, and debts. Then, allocate specific amounts toward essential expenses, savings, and debt repayment. Make sure you factor in everything from bills to groceries and transportation and keep track of your progress monthly. And yes, treating yourself occasionally is okay, but your debt should always be at the top of your mind. Sticking to your budget will help you pay off debt faster and with less stress.

Use budgeting apps to automate your spending tracking. This saves time and reduces the likelihood of overspending. And when in doubt, the 50/30/20 rule (50% for needs, 30% for wants, and 20% for savings and debt) is a great place to start.

Read: 6 Effective Ways to Overcome Financial Stress

2. Using Debt to Pay Off Debt

Ah, the classic mistake of trying to dig your way out of a hole by… digging deeper. It’s tempting to take out a new loan to pay off an old one, especially when the new loan offers “better terms” or comes with a shiny credit card. But this strategy often leads to more problems than it solves. You’re essentially shifting debt around instead of eliminating it—and that’s a slippery slope.

Relying on new credit to pay off old credit adds to the pile of interest, fees, and stress. It might provide temporary relief, but in the long run, you’ll likely end up owing even more. Instead, focus on paying down your existing debt using a solid plan, not quick fixes that only delay the inevitable.

The Fix: Avoid the temptation to borrow more to pay off old debts unless you’re consolidating your loans with a clear strategy for repayment. Debt consolidation can be a smart move if it reduces your interest rates and simplifies your payments, but make sure you have the discipline to stick to a single payment plan. The goal is to pay down debt, not juggle it.

If you’re considering consolidating, shop around for the best rates and terms, and consider talking to a financial advisor who can help you weigh the pros and cons.

3. Debt Without an Emergency Fund

Here’s a nightmare scenario: you’re making good progress on paying down your debt, and then—boom—your car breaks down, or you get hit with an unexpected medical bill. Without an emergency fund, where do you turn? That’s right, more debt. And just like that, you’re back to square one.

One of the biggest mistakes people make when paying off debt is neglecting to save for emergencies. Life is unpredictable, and the last thing you want is to undo all your hard work by relying on credit to cover surprise expenses. An emergency fund is your financial safety net, giving you peace of mind and a buffer for life’s “what ifs.”

The Fix: Build an emergency fund while paying off debt. It doesn’t have to be massive—a starting goal of ₦100,000 to ₦200,000 can help cushion unexpected expenses. Over time, aim for three to six months’ worth of living expenses. Having this cushion prevents you from relying on loans or credit cards when life throws you a curveball.

Automate savings to your emergency fund each month. Treat it like a non-negotiable expense; before you know it, you’ll have built a solid buffer without feeling the pinch.

Read: 5 Simple Tricks for Creating an Impactful Presentation

4. Keeping the Same Spending Habits

Here’s the brutal truth: you can’t pay them off while still living like nothing’s changed. Suppose you’re trying to climb out of debt but still hitting up the latest sales, indulging in takeout every other night, or subscribing to multiple streaming services. In that case, you’re essentially trying to run a marathon with your shoelaces tied together. It’s not going to end well.

Debt repayment requires a mindset shift, which means reevaluating your spending habits. If your spending patterns remain the same, your debt will, too. This doesn’t mean you can’t enjoy life, but it does mean you need to make intentional spending choices and cut back on the non-essentials until you’re debt-free.

The Fix: Start by identifying where your money is going. Look for areas where you can cut back, such as dining out, entertainment, or impulse shopping. Reallocate that money toward your debt. Make it a habit to ask yourself before any purchase: “Do I really need this?” or “Could this money go toward my debt instead?”

Try implementing a 24-hour rule for any non-essential purchases. If you see something you want, wait 24 hours before buying it. Often, the urge will pass, and you’ll save that money for your debt instead.

Paying off debt is a marathon, not a sprint. It takes discipline, consistency, and avoiding the common mistakes that can derail your progress. By budgeting effectively, steering clear of the temptation to use debt to pay off debt, building an emergency fund, and changing your spending habits, you’ll be well on your way to financial freedom.

Ready to take charge of your debt repayment journey? Follow us for more actionable financial tips and strategies, and start making smarter money moves today.