Thanks to the boom across the African fintech industry, saving money is now more easy than ever. With access to various effective fintech platforms, it is now super convenient to stash away some cash and build financial stability. Here are eight fintech platforms that are transforming the savings culture in Africa.

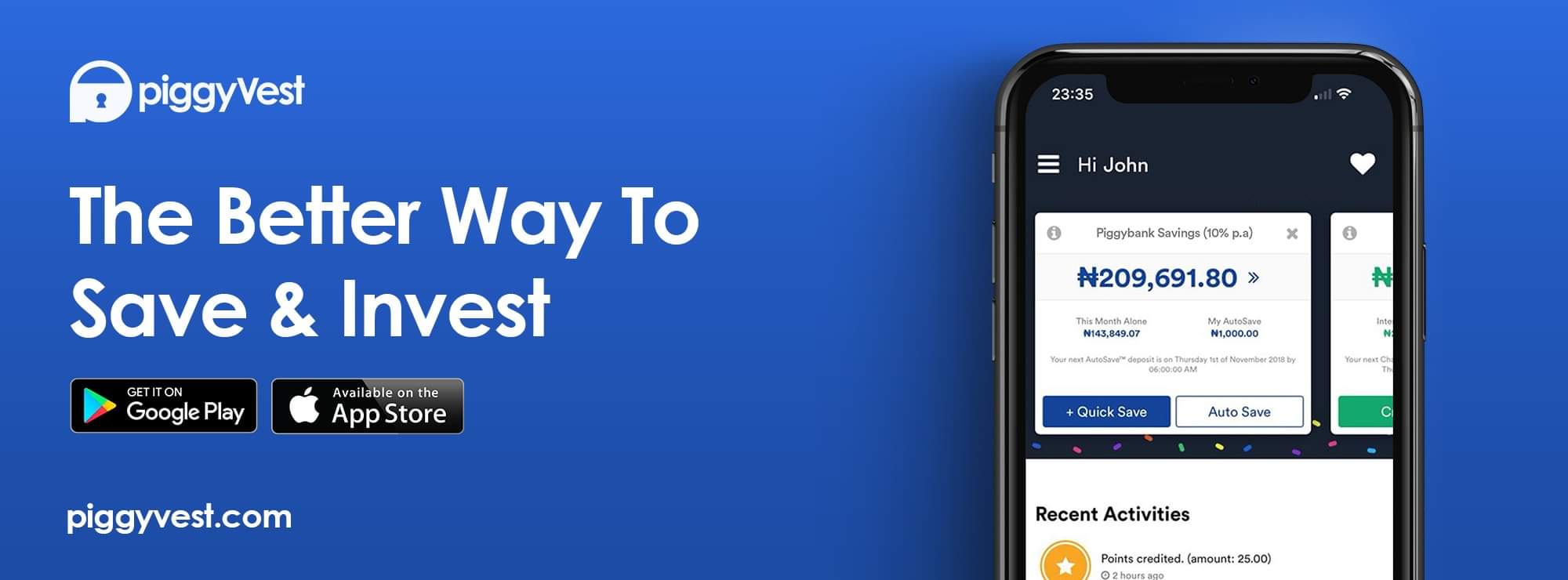

1. PiggyVest

Having a PiggyVest app is like having your personal piggy bank on your phone. Whether you’re saving for a dream vacation or stacking up for a rainy day, with PiggyVest, you can do that and more. PiggyVest allows you to save regularly, invest, and join a savings group with friends.

For PiggyVest users, your saving habit can be daily, weekly, or monthly, depending on your preference. You are also allowed four free-of-charge withdrawals annually. However, only one withdrawal is allowed within 24 hours.

Here’s the fun part—PiggyVest has a SafeLock feature that gives you about 15.5% interest upfront on your savings. You can decide to lock all or part of your savings and get it back at a convenient time.

PiggyVest is available on all platforms (Web, Android, and iOS).

Interest rate: 8% per annum on Piggybank, up to 13% per annum on SafeLock, 8% per annum on Target, 8% per annum on Flex, 7% per annum on Flex Dollar

Savings Plan: Piggybank, Safelock, Target Savings, FlexNaira & Flex Dollar.

2. Cowrywise

Next on the list is Cowrywise – the plug for all things savings and investment. From flexible savings plans to solid investment options, these guys make it easy for us to level up our money game.

Cowrywise is another fantastic platform for automated savings. Its saving options and interest rate differ from others. It allows you to use periodic savings plans, where you can save daily and monthly, with an interest rate of 10% annually.

For Cowrywise, users can deposit a fixed amount for three months and earn up to 15% per annum on the savings. You can only withdraw with your interest at the withdrawal date you set.

An exciting feature of Cowrywise is Halal savings. Halal Savings offers interest-free savings options for users who don’t support interest on savings due to religious reasons.

Cowrywise is available on all platforms (Web, Android, iOS)

Interest rate: 10% to 15%

Savings Plans: Regular savings, Life Goals, and Halal Savings

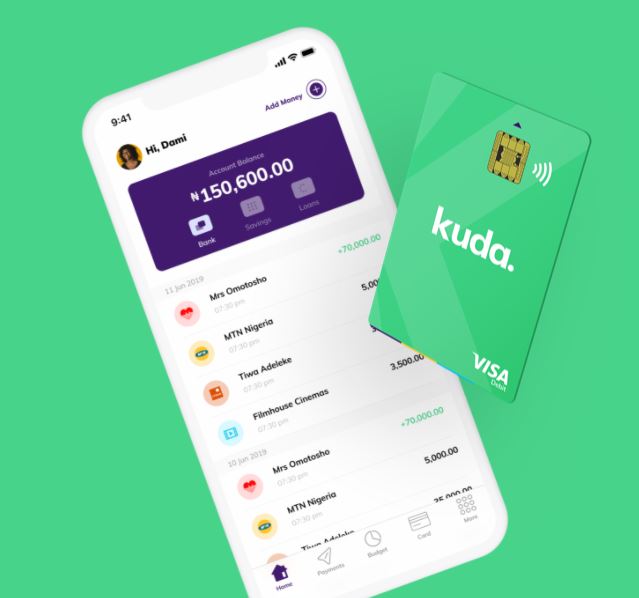

3. Kuda Bank

Kuda Bank is the “new kid on the block,” staking its claim in the banking scene. It is a fully online bank that allows you to open an account without any paperwork—easy-peasy.

As a digital-only bank, all operations happen on your phone. It is worthy of mention as one of Nigeria’s top online saving platforms. The platform charges zero monthly fees and offers users a free debit card. The interest rate for savings plans is as high as 15%, and you get a specified interest rate after setting up your savings plan.

Kuda has plans to start offering loans and P2P payment options to its customers soon.

Kuda is available on all platforms (Web, Android, and iOS)

Interest rate: 10% – 15%

4. ALAT by Wema Bank

Meet the first fully digital bank in Nigeria. ALAT by Wema is one of the best savings platforms in Nigeria, offering essential banking services and reasonable interest rates.

ALAT operates like any other traditional bank. The bank offers a free debit card, but it comes with a monthly maintenance fee. They offer an interest of about 4.2%, depending on your monthly withdrawals. In this case, it shouldn’t exceed three withdrawals.

ALAT has several savings plans that offer up to 10%; one allows user to withdraw about 50% of their savings once every 30 days, while another restricts withdrawal.

ALAT by Wema Bank is available on all platforms (Web, Android, iOS)

Interest rate: 4.2%

Withdrawal charges: Withdraw cash for free using your Wema Bank debit card at their ATMs or the first three times a month at other bank ATMs, after which a fee of ₦65 will be charged.

5. V Bank by VFD

V Bank, owned by VFD Microfinance Bank, is another popular savings platform that allows you to save money on your phone. With V Bank, you can open an account in just minutes.

V Bank has features allowing users to track their income and expenses, group budgets, and set spending limits. The digital bank gives up to 12% interest on savings and has a withdrawal limit.

V Bank is available on all platforms (Web, Android, and iOS)

Interest rate: 12%

Read: 6 Tips for Developing a Desirable Savings Culture

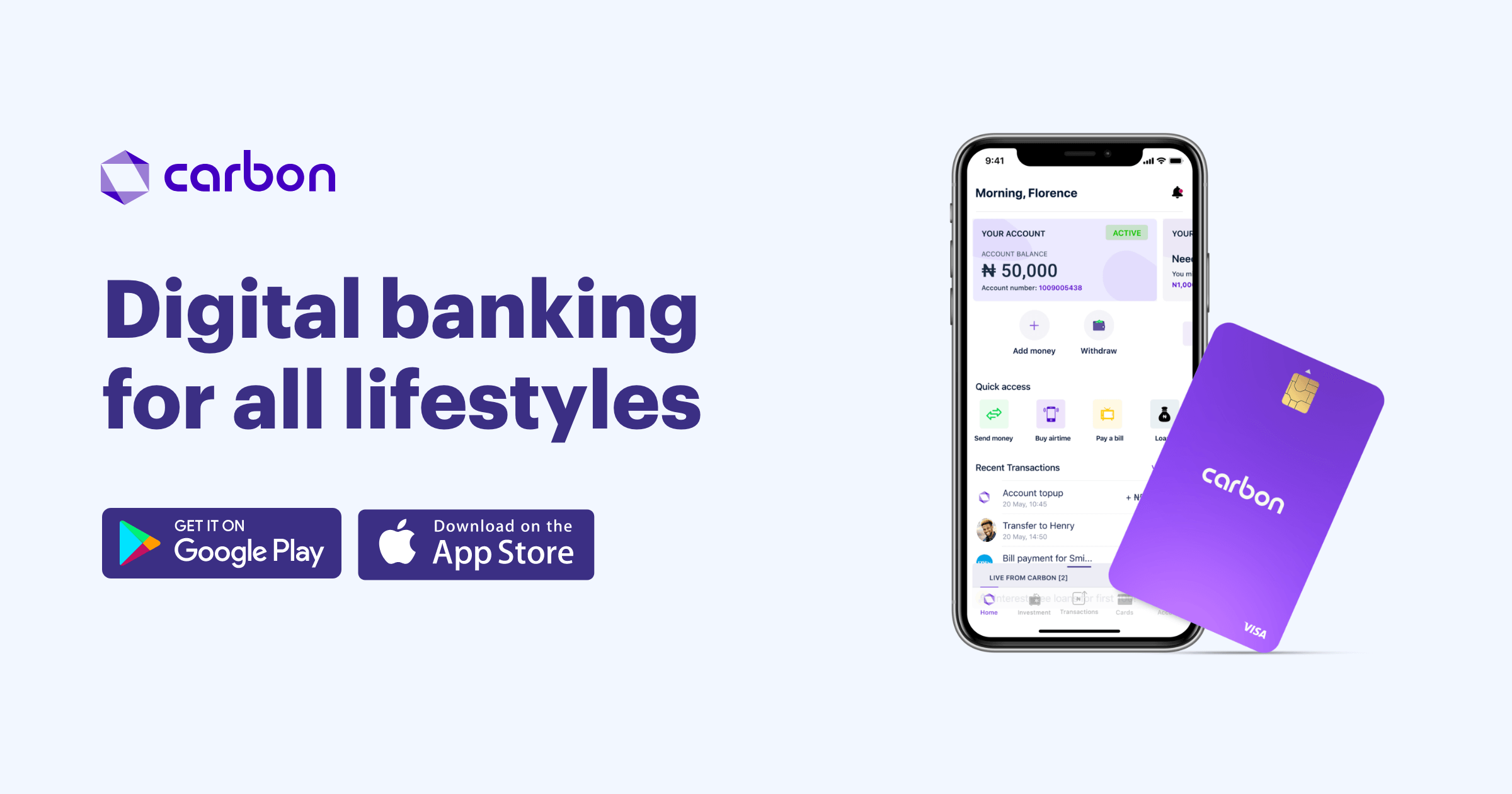

- Carbon (formerly Paylater)

When it comes to digital financial services, Carbon is the real MVP. Formerly known as Paylater, the platform initially offered collateral-free loans in Nigeria. Now, Carbon has transitioned into digital banking and offers multiple banking services.

With Carbon, you can create a bank account, physical debit cards, and virtual cards. The platform offers users suitable savings plans with an interest rate of about 15.5% between 3 and 12 months. You can also make payments from the app, keep track of your credit history using the carbon credit report feature, and access loans.

Carbon is available on the Web and Android

Savings Plan: Cash vault, Goals, FlexSave

Interest rate: Up to 15.5% (3 – 12 months terms)

7. PayDay by ARM

When it’s payday, you know it’s time to celebrate—and with Payday, you can do just that. PayDay aims solely to increase financial awareness and bring the younger generation into the financial circle.

With PayDay, you can create a savings goal. The company then invests the fund on your behalf in mutual funds. You can also track your expenses using the app and get personalized tips to help you make smarter financial decisions.

When you use a debit card to fund your PayDay Investor account, the card payment platform provider charges a 1% convenience fee.

Platforms: Web, Android, and iOS

Interest rate: 12.6%

Withdrawal charges: NEFT transfer fee of ₦52.50.

Read: Dr. Olumide Abimbola, a financial expert facilitating trade and financial inclusion

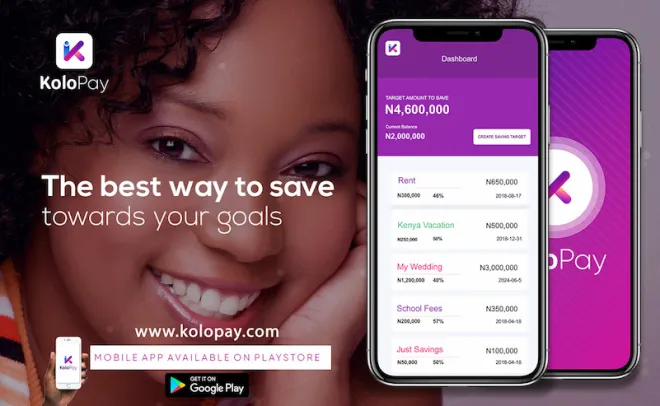

8. Kolopay

Kolopay is an app that helps you save money without even trying. With Kolopay, you can set up automatic savings, earn rewards for hitting your goals, and even get tips on how to save more. It’s savings made simple so you can reach your financial dreams faster.

You cannot withdraw a partial amount of your savings. You can only withdraw the entire amount, even before the due date of your savings goal.

The Kolopay platform lets you share your savings goal with your loved ones and friends. This feature allows them to contribute to achieving your set target.

KoloPay Deal is an exclusive feature of the Kolopay platform that offers users massive discounts on various products and services.

Platform: Web, Android

Interest rate: 6% per annum

Withdrawal charges: 5% charge if a withdrawal is made before the set date.