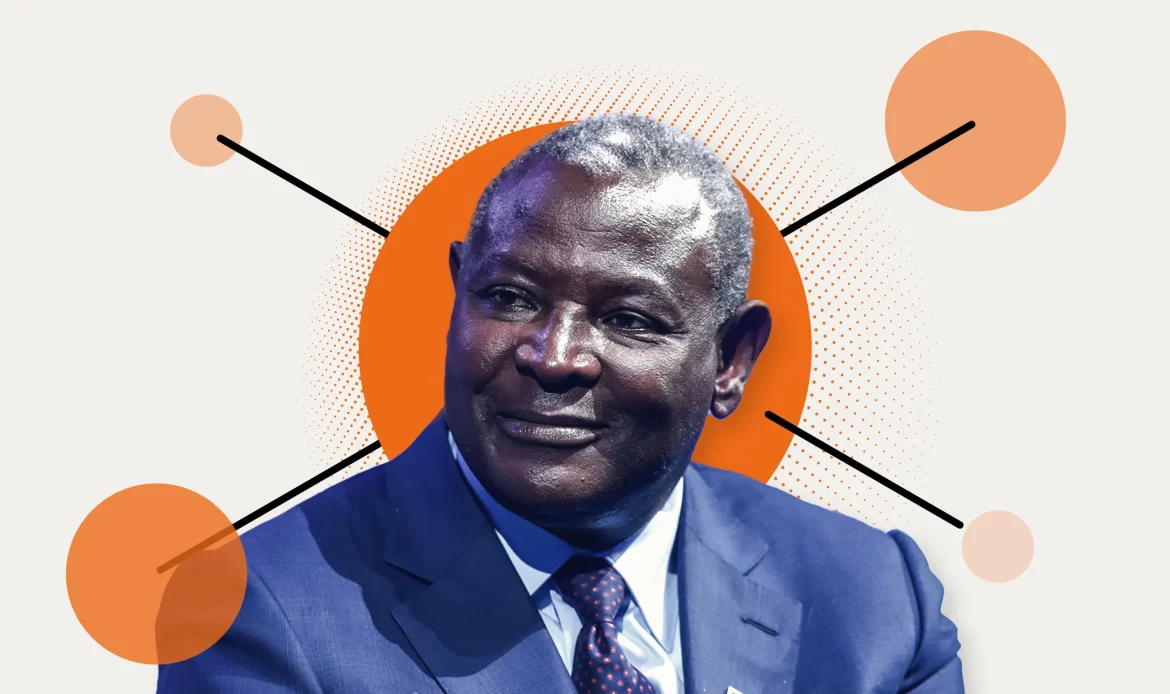

In a continent where millions are often excluded from the financial system, one man stands out as a champion of change—James Mwangi. As the CEO and Group Managing Director of Equity Group Holdings Plc, Mwangi has reshaped the Kenyan banking landscape and driven a financial revolution across East and Central Africa.

With a career spanning over three decades, his leadership has been marked by innovation, inclusivity, and an unyielding commitment to improving the lives of ordinary Africans. Today, Mwangi is celebrated not just as a successful business leader but as a visionary whose work has created a profound social and economic impact across the continent.

Early Life and Humble Beginnings

James Mwangi’s remarkable journey to the top is rooted in his humble beginnings in Kangema, Muranga County, Kenya. Raised in a rural setting, Mwangi was acutely aware of many Kenyans’ struggles in accessing basic financial services. Growing up in a society where banking was out of reach for most people shaped his deep desire to change the system.

After earning a degree in Commerce from the University of Nairobi, Mwangi worked at various financial institutions before joining Equity Building Society, a struggling mortgage lender at the time. His mother, a small-scale businesswoman, could not access financial services, which motivated Mwangi to join Equity and work on a solution.

Mwangi’s mission was clear from the start: to make banking more accessible to the average person, particularly low-income individuals who traditional banks had overlooked.

Read: Everything You Need to Know About Felabration 2024: A Celebration of Afrobeat and Cultural Legacy

Transforming Equity Bank: From a Struggling Building Society to a Banking Giant

James Mwangi joined Equity Building Society in 1993 when it was on the brink of collapse. The institution had a mere 27,000 customers, and its capital base was below the statutory minimum. Most financial experts had written it off, but Mwangi saw potential in the small bank. His first move was to restructure the organization from a mortgage lender into a fully-fledged commercial bank, rebranding it as Equity Bank.

Under Mwangi’s leadership, Equity Bank adopted a customer-centric model that made banking services affordable and accessible to Kenya’s underserved population. In a bold move, he eliminated the minimum balance requirement for opening an account, making it possible for millions of Kenyans—many of whom were living below the poverty line—to join the formal financial system for the first time.

Mwangi also championed financial literacy programs, teaching customers how to manage their accounts, save money, and access loans. His emphasis on education and empowerment and a focus on customer service fueled Equity Bank’s rapid growth. What began as a struggling institution soon became the largest bank in Kenya by customer base, with over 18 million accounts as of 2023.

Innovating Financial Inclusion: Agency Banking and Mobile Solutions

James Mwangi’s impact extends far beyond the expansion of physical bank branches. Recognizing that traditional banking infrastructure could not reach everyone, especially in rural and remote areas, Mwangi spearheaded the introduction of agency banking. This innovative model allows local shops, grocery stores, and other small businesses to act as bank agents, enabling customers to deposit, withdraw, and transfer funds without visiting a bank branch. This approach revolutionized banking for rural populations, bringing financial services closer to their homes and businesses.

Additionally, Equity Bank was one of the first African banks to embrace mobile and digital banking on a large scale. Mwangi saw the potential in mobile technology early on and capitalized on Kenya’s growing mobile penetration by partnering with telecom companies. The result was the introduction of mobile banking platforms like Eazzy Banking, which now handles 99% of all Equity Bank transactions.

These digital platforms enable customers to open accounts, apply for loans, transfer money, and pay bills via their mobile phones. By adopting these innovations, Mwangi has expanded financial access and reduced operational costs, allowing the bank to offer more affordable services to its clients.

Championing Financial Literacy and Economic Empowerment

James Mwangi’s leadership at Equity Group Holdings is underpinned by a broader mission of economic empowerment. Recognizing that many of the bank’s customers were small-scale farmers, traders, and entrepreneurs, Mwangi introduced a range of tailored products and services designed to uplift these groups. Equity Bank offers micro-loans, agricultural financing, and business training programs, all aimed at fostering entrepreneurship and economic growth at the grassroots level.

Through the Equity Group Foundation, Mwangi has extended his impact on financial literacy by launching programs that provide training on managing finances, improving business skills, and enhancing productivity. This commitment to empowerment has ensured that many of Equity Bank’s customers are financially included and able to grow their businesses and improve their livelihoods.

The Wings to Fly Program: Uplifting Kenya’s Brightest Minds

One of James Mwangi’s most enduring legacies is his focus on education through the Wings to Fly scholarship program. Launched in 2010 in partnership with The MasterCard Foundation, the program provides full scholarships to Kenya’s underprivileged but academically talented students. Wings to Fly has supported over 26,000 scholars, many of whom have gone on to attend prestigious universities around the world, including Harvard, Yale, and Oxford.

This initiative reflects Mwangi’s deep belief in the power of education as a transformative tool. For Mwangi, education is the key to unlocking opportunities and breaking the cycle of poverty. By investing in young talent, he has helped shape a generation of leaders and professionals who contribute to Kenya’s social and economic development.

Read: Julienne Lusenge: A Beacon of Hope for Women’s Rights in Conflict Zones

Regional Expansion: Strengthening Africa’s Financial Ecosystem

James Mwangi’s ambitions for Equity Group extend beyond Kenya’s borders. Under his leadership, the bank has expanded into six African countries: Uganda, Tanzania, Rwanda, South Sudan, the Democratic Republic of Congo (DRC), and Zambia. The acquisition of BCDC in the DRC was a strategic move that positioned Equity as a major player in Central Africa’s banking sector.

Mwangi’s goal is to create a Pan-African financial institution that promotes financial inclusion across the continent. His vision for regional expansion aligns with his belief that Africa’s economic potential can only be realized when more people have access to financial services, thus enabling trade, entrepreneurship, and economic growth across borders.

Accolades and Recognition

James Mwangi’s contributions to the financial sector and society have not gone unnoticed. He has received numerous awards, including the Ernst & Young World Entrepreneur of the Year (2012), the first African to receive the prestigious Financial Times’ Banker of the Year (2015) for transforming Equity Bank and driving financial inclusion, and African CEO of the Year (2017) by Africa CEO Forum.

In addition to these individual honors, Equity Group Holdings has consistently been ranked as one of the top banks in Africa in terms of innovation, customer service, and financial performance.

Beyond banking, Mwangi continues to invest in philanthropic activities and economic development initiatives that benefit Africa’s people long-term. His work is a testament to the idea that business success and social impact can—and should—go hand in hand.

Stay connected with RefinedNG to learn more about innovative Africans and their strategies for driving financial inclusion and economic growth. Join the conversation and discover ways you can contribute to Africa’s financial transformation.