In the labor market today, a silent revolution is taking place. The traditional 9-to-5 job is making way for the gig economy, a landscape where flexibility and independence reign supreme.

For freelancers navigating this new world, financial stability can be as elusive as it is essential. While conventional wisdom offers some guidance, the real gems lie in the unconventional financial tips that most freelancers overlook.

Here are a few tips to ensure you’re not just surviving but thriving in the gig economy.

Financial Tips for Freelancers

Imagine your financial life as a blank canvas. Each gig, each project, and each client is a brushstroke that can create a masterpiece or a chaotic mess. The key to a successful freelancing career isn’t just about securing projects but mastering the art of financial management.

This requires not only the basics of budgeting and saving but also the more nuanced, often overlooked strategies that can set you apart. Let’s explore these unconventional tips to transform your financial canvas into a masterpiece.

1. Diversify Your Income Streams

In the gig economy, the phrase “don’t put all your eggs in one basket” takes on a whole new meaning. Relying on a single client or a specific type of work can be risky. Instead, diversify your income streams. This doesn’t just mean having multiple clients but also exploring different kinds of freelance work.

For example, consider branching out into editing, content strategy, or even teaching writing workshops if you’re a writer. This diversification can help stabilize your income and provide a financial cushion during lean times.

Read

: The Psychology of Spending: Understanding Your Financial Habits

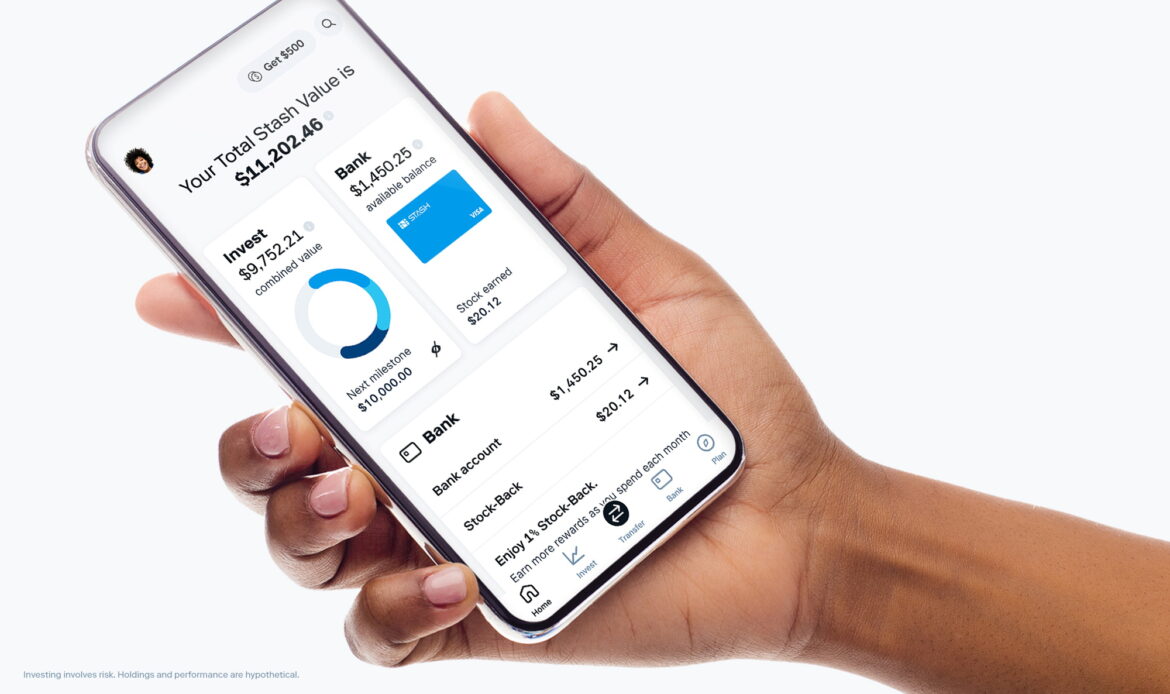

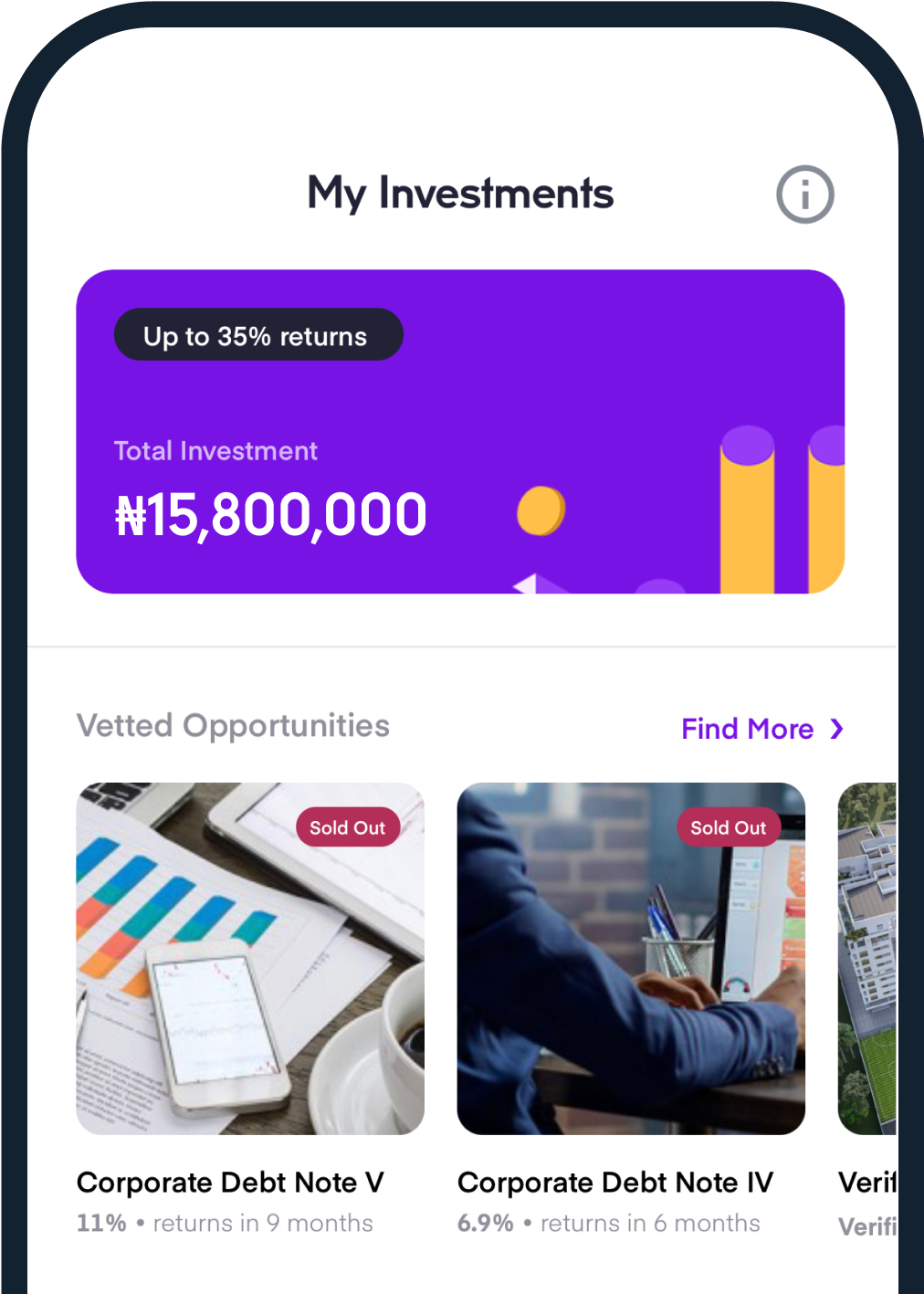

2. Embrace the Power of Micro-Investing

Traditional investing might seem daunting, but micro-investing offers a more accessible route. Platforms like Trove and Chaka allow you to start investing with as little as ₦1,000. These platforms enable you to buy fractional shares of international companies, giving you a taste of global financial markets.

You can build a significant portfolio over time by consistently investing small amounts without feeling the pinch in your daily finances.

3. Optimize Your Payment Terms

Freelancers often need help with irregular cash flow due to delayed payments. One way to mitigate this is by optimizing your payment terms. Consider offering a discount for early payments or charging a late fee for overdue invoices.

Additionally, requesting an upfront deposit can help cover initial expenses and ensure clients are committed. Clear, well-structured payment terms improve cash flow and set a professional tone with your clients.

3. Leverage Digital Tools for Financial Management

The digital age offers an array of tools designed to simplify financial management. Apps like Mint or YNAB (You Need a Budget) can help you track your income, expenses, and savings goals. For Nigerian freelancers, platforms like Kuda and PiggyVest offer innovative banking and savings solutions tailored to your needs. These tools provide real-time insights into your finances, helping you make informed decisions and avoid financial pitfalls.

4. Take Advantage of Tax Deductions

Freelancers often miss out on valuable tax deductions simply because they’re unaware of them. In Nigeria, business-related expenses such as internet bills, office supplies, and even a portion of your rent (if you work from home) can be deducted from your taxable income.

Keeping meticulous records of these expenses can significantly reduce your tax liability. Consider consulting with a tax professional to ensure you take full advantage of available deductions.

Read: Upskilling vs. Reskilling: Which One is Right for Your Career?

5. Establish a Financial Safety Net

In the unpredictable world of freelancing, having a financial safety net is crucial. Aim to save at least three to six months’ living expenses in an emergency fund. This fund can help you weather periods of low income or unexpected expenses without going into debt. Building this safety net requires discipline and consistency, but the peace of mind it provides is invaluable.

6. Invest in Continuous Learning

The gig economy is dynamic and ever-changing. To stay competitive and command higher rates, invest in continuous learning. Online courses, certifications, and workshops can help you acquire new skills and enhance your expertise. Platforms like Coursera, Udemy, and LinkedIn Learning offer affordable learning opportunities. By continually improving your skill set, you increase your value to clients and open new income opportunities.

Read: Insurance: The Financial Safety Net

7. Build Strong Relationships with Clients

While this might seem more like a business tip than a financial one, strong client relationships can lead to more stable income. Reliable clients are more likely to provide consistent work, refer you to others, and even pay higher rates for quality service. Take the time to understand your clients’ needs, communicate effectively, and deliver outstanding work. Building trust and rapport can turn one-off projects into long-term partnerships.

8. Protect Yourself with Contracts

One of the most overlooked aspects of freelancing is the importance of contracts. A well-drafted contract can protect you from non-payment, scope creep, and other common issues. Ensure your contracts clearly outline payment terms, project scope, deadlines, and deliverables. This not only provides legal protection but also sets clear expectations for both you and your client.

The gig economy in Nigeria offers unparalleled opportunities for those willing to take the plunge. However, navigating this landscape requires more than just hard work and talent; it requires smart financial management. You can create a stable and prosperous freelancing career by embracing these unconventional tips.

Remember, your financial life is a canvas, and with the right strategies, you can paint a masterpiece that reflects not just survival but success.