December is the month when wallets sigh and budgets cry. In a country like Nigeria, where Detty December has become a cultural phenomenon, the pressure to spend extravagantly on events, trips, gifts, and other festive indulgences is enormous. It’s the season where friends pull out all the stops for Instagram-worthy outings, family gatherings stretch financial limits, and social invitations come with unspoken expectations of matching their energy and expenses.

Peer pressure spending in December can be so real that it leaves many scrambling to recover well into January. But here’s the thing: it doesn’t have to be this way. You can celebrate the season, join the fun, and still keep your finances in check. It all begins with mastering the art of saying no.

As December approaches, let’s explore practical, real-world ways to handle this without becoming the “boring” one in the group or feeling guilty about protecting your financial health.

Understand Why December Hits Different

The festive season has a way of magnifying social obligations. Suddenly, every weekend has a wedding, a reunion, or a detty party. Friends are planning group trips to Ghana or Zanzibar, while others attend back-to-back concerts. It’s easy to feel like you’re missing out or disappointing your loved ones if you’re not matching their vibe. But here’s the truth: many people are running on empty wallets too. Many won’t admit it, but they often fund these lifestyle choices with debt or sacrificing their future savings.

The first step to overcoming peer pressure spending is understanding the psychological triggers. Social media highlights everyone’s best moments, making it seem like they’re living the high life 24/7. Most people are just as worried about their finances as you are. Remember that staying true to your financial goals is far more rewarding than temporary validation from others.

Read: Why November is Your Last Chance to Save for Detty December

Define Your Priorities for the Month

Before the December buzz fully kicks in, take some time to map out what matters most to you. What kind of experience do you truly want? Is it spending quality time with family, attending one or two key events, or saving for a significant goal in January? Once you’re clear about what you want from the season, it becomes easier to filter out unnecessary obligations.

For instance, if traveling to your hometown is a must, you can focus your budget there, and decline invites to costly events in the city. If you’ve decided to save aggressively for a project in 2024, remind yourself of the bigger picture every time temptation arises. Saying no becomes a natural extension of your priorities rather than an emotional decision in the heat of the moment.

Master the Art of Saying No (Without the Guilt)

Saying no is an essential skill, especially in December, but it doesn’t have to feel awkward. Practice polite and firm responses that communicate your decision without inviting further debate. For instance, if friends invite you to an expensive outing, you can say, “That sounds like fun, but I’m prioritizing other expenses right now. Let me know the next time something comes up.”

Another approach is to suggest alternatives. If a friend wants to hit an expensive rooftop bar, propose a more budget-friendly option, like a picnic or movie night at home. This way, you’re not rejecting their company, just the costlier plan. Most of the time, your friends will respect your honesty and might even appreciate your creativity.

Avoid Emotional Spending Triggers

December is an emotional rollercoaster. The nostalgia of the year coming to an end, coupled with the excitement of festivities, can make even the most disciplined spender lose focus. Add peer pressure to the mix, and you may buy things you don’t need just to feel included. Emotional spending is one of the biggest culprits during the holiday season.

To combat this, try these strategies:

- Pause Before You Spend: If you’re tempted to say yes to an invitation or impulse-buy an expensive outfit, give yourself 24 hours to think about it. Often, the urgency to spend fades with time.

- Set Boundaries with a Budget: Establish a clear monthly spending limit and stick to it. Track every expense, no matter how small, to avoid surprises later.

- Surround Yourself with Supportive People: If your circle of friends makes you feel bad for setting boundaries, it may be time to reassess those relationships. Prioritize people who uplift and respect your decisions.

Read: How to Prioritize Needs Over Wants As December Approaches

Turn FOMO Into JOMO (Joy of Missing Out)

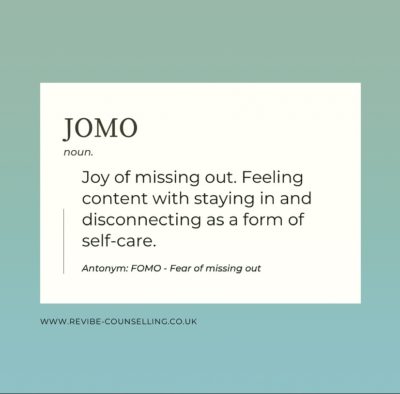

It’s hard to scroll through Instagram or WhatsApp statuses in December without feeling FOMO (fear of missing out). But what if you flipped the script and embraced JOMO—the joy of missing out? Instead of dwelling on what you’re not doing, focus on the peace and financial security you’re gaining by not overextending yourself. Remember, Detty December is just one month, but financial regret can linger for years if you’re not careful.

Start small by appreciating the things you can do within your budget. Host a cozy dinner with friends at home or walk through a local Christmas market instead of shelling out for every big-ticket event. By intentionally creating meaningful, low-cost experiences, you can still enjoy the season without the FOMO-induced spending.

Stay True to Your Goals

The most important thing to remember during Detty December is that your choices today will impact your financial future. Every naira saved or spent is a step toward your goals—or away from them. While peer pressure can feel overwhelming, staying grounded in your own values and aspirations will help you make better decisions.

RefinedNG has resources to help you plan your finances and navigate the festive season smartly if you need additional guidance. With the right mindset, you can enjoy Detty December to the fullest—without sacrificing your January peace of mind.